5 First Time Home Buyer Loans Mistakes

As a first time home buyer one of the biggest and most important challenges is getting a home loan. Here is a list of 5 first time home buyer loans mistakes you can avoid.

1. Getting A Loan Amount That Is More Than You Can Afford.

When you’re shopping for a home loan it’s very common for mortgage companies to say you qualify for an amount that is higher than you can afford. In general your mortgage payment should be about 25% of your monthly take home pay. So just because you can spend more does not mean it’s a wise idea. Write out a budget so you know how much you can afford.

2. Choosing A Loan With A Mortgage Insurance Premium.

Many first time home buyer loans have a mortgage insurance premium (MIP). This is an insurance policy used with FHA loans if your down payment is less than 20%. With FHA loans this additional fee is a part of your mortgage payment forever. This does not go away even if you build up 20% equity in your home over time. If you can do a conventional loan with 20% down payment you’ll avoid paying mortgage insurance premiums. Saving up for a down payment can save you big money in the long term.

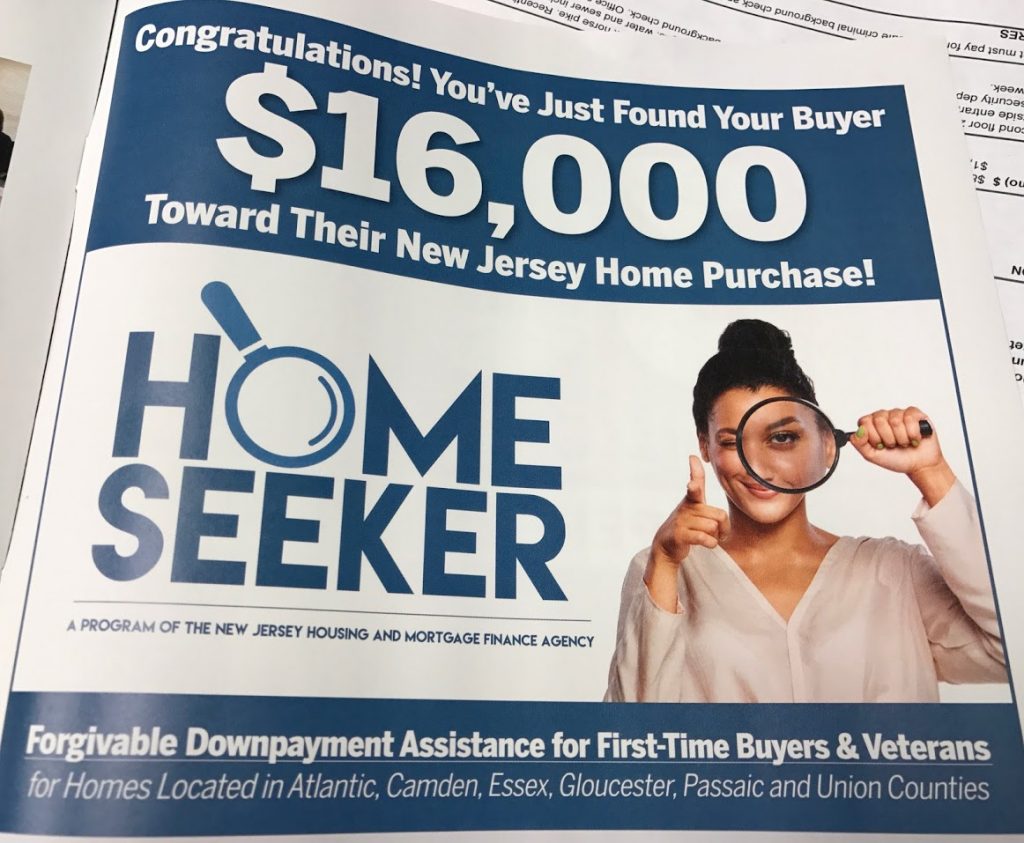

3. Not Taking Advantage Of Available Grants And Programs For First Time Home Buyers.

There are often local grant programs available for first time home buyers like the Atlantic County $10,000 grant and the NJ $10,000 grant. These programs give first time home buyers $10,000 towards down payment and closing costs. This money is forgiven after you keep the house a certain number of years. Yes this is free money! The challenge with the grant money is that not everyone qualifies and it’s not always available. Working with the right mortgage expert who knows the ins and outs of these programs will help you determine the best loan option for you and if you qualify for any available programs.

4. Not Knowing Your Closing Costs.

Most first time home buyers realize they’re going to need some kind of down payment. However they often don’t realize there will be additional closing costs. These additional costs will be paid at closing and include settlement fees, title insurance, mortgage fees, and escrows for taxes and home owners insurance. Your mortgage officer can give you an estimate for what your closing costs will be. And if you’re limited on funds we can negotiate the seller to pay your closing costs for you.

5. Choosing An Online Mortgage Company.

There are many online mortgage companies out there making great offers and claims. Here is why I don’t recommend using one. Real estate is local. An online mortgage company will not be familiar with the local market conditions, neighborhoods and associations. Online lenders won’t be aware of any local first time home buyer grants or programs. You can’t meet face to face with an online lender to have them explain loan options and documents with you. You can’t drop off documents to an online lender that is thousands of miles away. A local mortgage officer will give you better service a personal touch and will often have equal or better rates and programs compared with online lender.

For answers to all your mortgage questions you can ask here and we will get back to you ASAP!

I hope this list of 5 First Time Home Buyer Loans Mistakes helps as you’re searching for a first time home buyer loan. We are here to help. Contact us if you need help with your loan.

Best wishes,

Matt

Also check out my 3 things you need to know as a first time home buyer!

to 6:30 PM

to 6:30 PM