As a real estate agent I’ve helped dozens of first time home buyers over the years and I’ve learned there are 3 things you should know before buying a home as a first time home buyer. Now the first one may be a surprising and the second two may be obvious. So lets dig in to these three items now.

3 Things you Need to Know as a First Time Home Buyer

1. It’s Okay Not To Buy A House

Many first time home buyers feel like they have to buy a house! We just got married – have to buy a house. I just graduated college… time to buy a house. I’m 38 years old and live in my parents basement… you really should buy a house then!

So here is my point. Just because you are at a certain stage in life does not mean you should buy a house. One of the big problems I see is people want to buy a house who really can’t afford it. Maybe they’ve just graduated college but have a huge amount of debt or student loans. It may be best to pay off the debt first and then save money for down payment before purchasing. Also it’s not wise to buy a home unless you see yourself living there for at least 5 years. Renting is a great option if you’re not ready to buy. Don’t listen to everyone who says you have to buy a house.

So here is my point. Just because you are at a certain stage in life does not mean you should buy a house. One of the big problems I see is people want to buy a house who really can’t afford it. Maybe they’ve just graduated college but have a huge amount of debt or student loans. It may be best to pay off the debt first and then save money for down payment before purchasing. Also it’s not wise to buy a home unless you see yourself living there for at least 5 years. Renting is a great option if you’re not ready to buy. Don’t listen to everyone who says you have to buy a house.

2. Know Your Mortgage Options

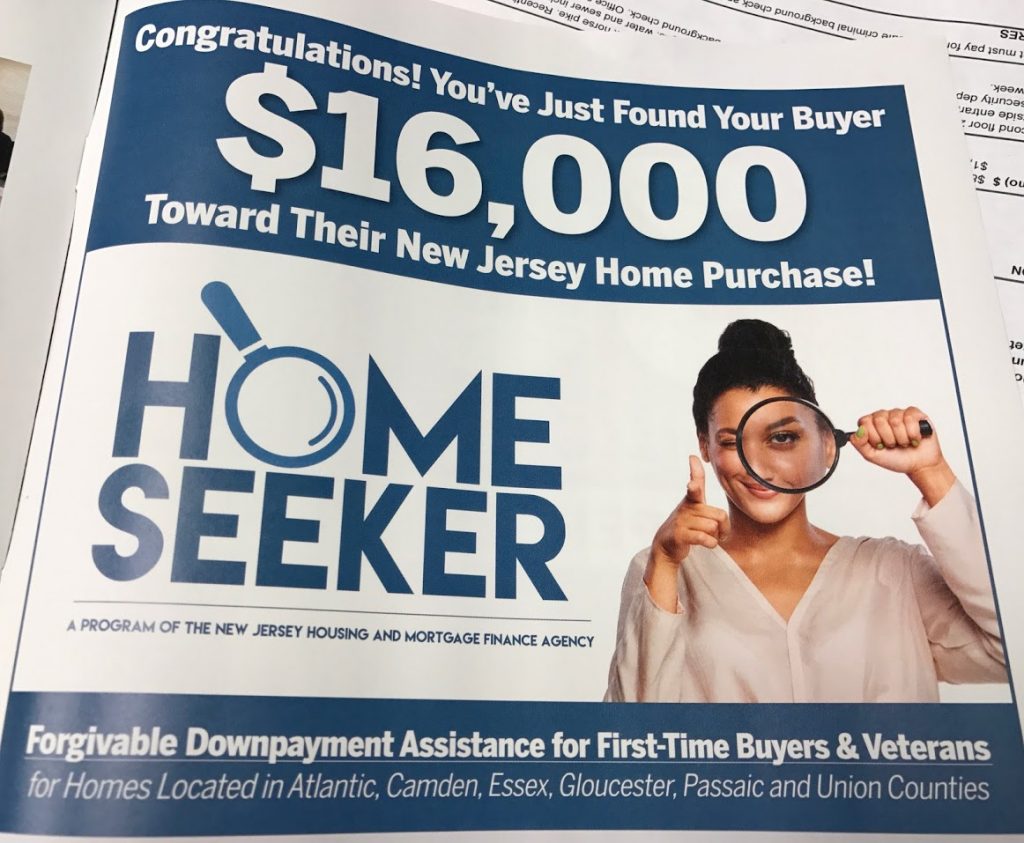

The biggest step as a first time home buyer is to qualify for a mortgage, what loan program to use and how much you can afford. The mortgage company will look at credit scores, debt and income to determine if you qualify for a mortgage. You’ll also want to determine what mortgage program is right for you. I always recommend a conventional loan at 20% down payment to avoid paying a mortgage insurance premium every month. There are other programs with zero down like a USDA or VA loan, and low down payment options like 3.5% down with FHA. It’s important to select a local mortgage company and loan officer who knows the area and all available loan options including any local grants and programs for first time home buyers.

3. Select The Right Real Estate Agent

Everyone knows someone in real estate, right? Selecting the right real estate agent is the next biggest step as a first time home buyer. Selecting an agent because they are a friend or friend of the family can be a disaster. When interviewing or researching an agent here are a few great questions to ask:

- How long have you been in the real estate business?

- How many people do you help per year?

- Are you a full time agent?

These are simple questions and important ones. When you are making one of the biggest financial decisions of your life do you want someone helping you who is inexperienced, unresponsive and not organized?

Hopefully my 3 things you should know before buying a home as a first time home buyer helped you out as you start to look for your first home. Of course if you need a great mortgage consultant and real estate agent we are here to help. Contact me for a free consultation.

Best wishes,

Matt

You can see a success story of one of my first time home buyers here.