You’ve saved and planned and you’re ready to take the plunge into home ownership. There are many great mortgage choices for first-time homebuyers to consider. This list will break down some of the most popular options and provide links to find out more about the ones you may qualify for.

You’ve saved and planned and you’re ready to take the plunge into home ownership. There are many great mortgage choices for first-time homebuyers to consider. This list will break down some of the most popular options and provide links to find out more about the ones you may qualify for.

First Time Homebuyer Mortgage Options Around Atlantic County

FHA Loans are 15 or 30-year loans which are backed by the Federal Housing Administration under the U.S. Department of Housing and Urban Development (HUD). FHA Loans usually allow approval for borrowers with lower credit scores. These loans can also help through low down payment mortgages and lower closing costs. You’ll have to pay a slightly higher rate for mortgage insurance however, which can be paid upfront or annually.

USDA Loans are based on income for qualification and backed by the U.S. Department of Agriculture (USDA). These loans provide help with the purchase of houses located in certain rural areas and include zero down payment mortgage options for borrowers who qualify.

VA Loans are available to active military members and veterans through the U.S. Department of Veterans Affairs and are partially backed by the same. The goal with this program is to assist veterans in purchasing houses. These loans can include no down payment mortgage options and don’t require private mortgage insurance. They do require a one-time funding fee which is a small percentage of the total loan amount.

VA Loans are available to active military members and veterans through the U.S. Department of Veterans Affairs and are partially backed by the same. The goal with this program is to assist veterans in purchasing houses. These loans can include no down payment mortgage options and don’t require private mortgage insurance. They do require a one-time funding fee which is a small percentage of the total loan amount.

Good Neighbor Next Door assistance program offers loans for houses which have been foreclosed on at half price to qualified borrowers. This is an incredible program and as such has stringent guidelines. The Good Neighbor Next Door program is available only to borrowers who work in public service sectors as law enforcement professionals, teachers, emergency medical technicians (EMTs) or firefighters. The firefighters and EMTs must also work within the same jurisdiction as the house they are purchasing. These homes are offered in “revitalization areas” as defined by the FHA. These areas generally have a high number of foreclosed properties available.

Fannie Mae and Freddie Mac are government programs which help qualify first-time homebuyers who have low or moderate income with lenders. The Fannie Mae HomePath Ready Buyer Program in particular offers qualified first-time homebuyers up to 3% toward closing costs for HomePath Properties which were foreclosures under their loan programs.

Fannie Mae and Freddie Mac are government programs which help qualify first-time homebuyers who have low or moderate income with lenders. The Fannie Mae HomePath Ready Buyer Program in particular offers qualified first-time homebuyers up to 3% toward closing costs for HomePath Properties which were foreclosures under their loan programs.

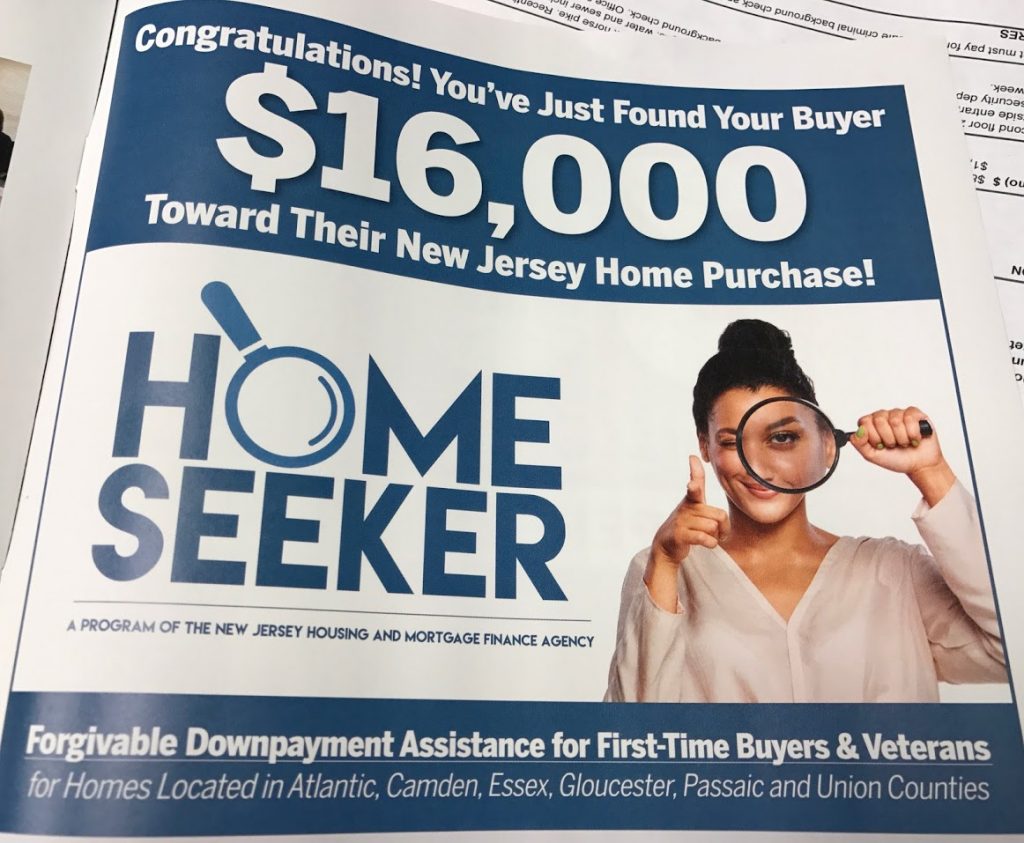

New Jersey State and Atlantic County Residents can also benefit from some wonderful down payment assistance options outlined in our previous post about First Time Homebuyers Government Programs. Check out the blog post to find out more about first time government programs that are available. These are great offerings specifically for area residents.

The options are too many to list but there’s sure to be something for most any first-time homebuyer to benefit from. For more choices and information see this informative Bankrate article.

Matt Haviland with The Haviland Group and Keller Williams Realty always offers free consultation for first-time homebuyers. Contact Matt today at 609-338-3773 or via e-mail to find out how he can help you.