One of the first questions asked when someone is planning to buy a home is, “How much do you have to put down to buy a house?” You may think the answer is a simple one, but this is not necessarily the case. The amount of a down payment needed depends on several factors and your own individual situation.

One of the first questions asked when someone is planning to buy a home is, “How much do you have to put down to buy a house?” You may think the answer is a simple one, but this is not necessarily the case. The amount of a down payment needed depends on several factors and your own individual situation.

The first thing to consider is what type of mortgage loan you can qualify for. The type of loan will determine what the minimum requirement is for a down payment on a house. If you qualify for a first-time buyer loan program, chances are you will need a lower down payment, good news for those struggling to save for this major investment.

For qualified buyers through the FHA you can buy with a down payment as low as 3.5%, or possibly with a zero-down payment, but there’s a price. If you qualify for this option, you’ll be required to pay for mortgage insurance for a while. Mortgage insurance isn’t for you but for your lender to be able to recoup the losses should you not make your payments. A down payment helps lessen the overall principal amount of a loan. The higher your down payment, the lower the principal funding. The more principal funding a lender provides, the more money they’re putting at risk in a loan.

While you may not need a down payment through an FHA loan, your monthly mortgage payment will include the cost of mortgage insurance from which you won’t directly benefit. This can be a worthy trade-off if saving for a down payment is a challenge. And the good news is, you won’t have to pay for mortgage insurance for the duration of your loan. When there’s a suitable amount of equity built into your property, you can request a review to discontinue the insurance.

While you may not need a down payment through an FHA loan, your monthly mortgage payment will include the cost of mortgage insurance from which you won’t directly benefit. This can be a worthy trade-off if saving for a down payment is a challenge. And the good news is, you won’t have to pay for mortgage insurance for the duration of your loan. When there’s a suitable amount of equity built into your property, you can request a review to discontinue the insurance.

Military veterans and active personnel can qualify for a VA loan, which will waive the down payment completely if you don’t have the funds to put down. These loans are provided through various lenders but backed by the US Dept. of Veteran Affairs. As such, if you don’t have a down payment you won’t have to include mortgage insurance. If you or your spouse has been a part of the military, this is an option worth looking into.

So how much of a down payment do you have to have for a house if you don’t qualify for a special program loan? The standard answer is 20% of the sale price. For a $100,000 home, this would mean you need $20,000 for a down payment. This is a sizable sum which can be a challenge for even the savviest saver. If you don’t have the full 20% however, not all is lost. Some lenders are willing to go as low as 5%-10% for a down payment, provided you pay for mortgage insurance to help lessen the risk to the lender.

To help avoid this extra expense though, you may be able to achieve the 20% down payment through a grant. While most grants are geared towards lower incomes and first-time home buyers, there are options for those in-the-middle-income buyers as well.

To help avoid this extra expense though, you may be able to achieve the 20% down payment through a grant. While most grants are geared towards lower incomes and first-time home buyers, there are options for those in-the-middle-income buyers as well.

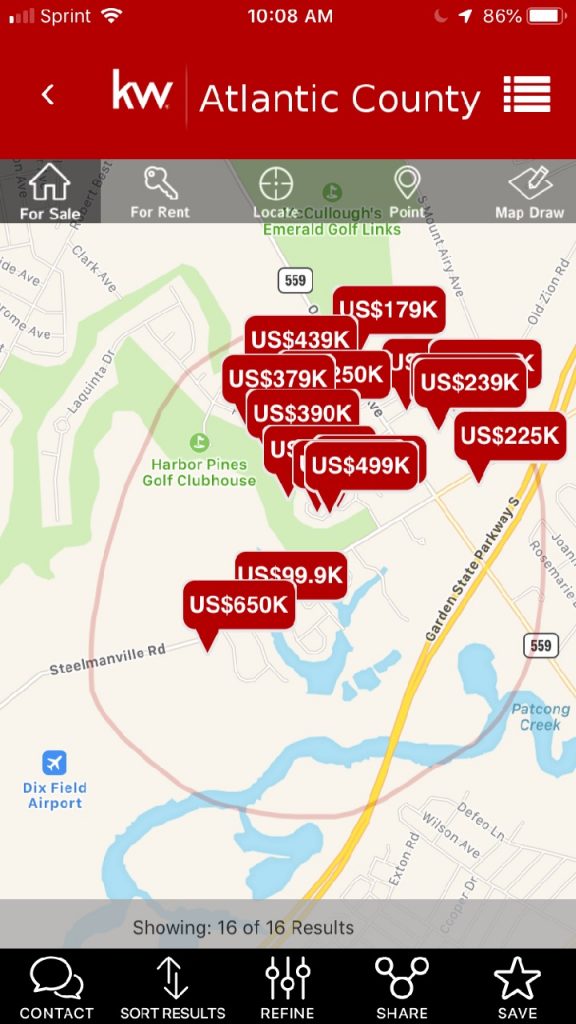

Learn more about down payments with this Bank Rate article. If it’s time to buy a home, get the conversation started with Matt Haviland; give him a call today at 609-338-3773 or send him an e-mail. Matt and his team are passionate about helping their clients achieve their home dreams; The Haviland Group and Keller Williams Realty are here to help you find the right home from start to finish.